A recap of our Plan

- School property taxes (averaging $2600/yr statewide) are completely eliminated

- The PA sales tax is raised from 6% to 8%. (And, non-WIC/SNAP foods and clothing items are taxed at 2%)

- The PA income tax is raised from 3.07% to 4.95%

- Retirement income (401k, 403b, Public/Private pension) is now taxed like income:

- Except Social Security

- Except Social Security equivalents (like State Police)

- Except contributions (which were already taxed 'going in')

- Except Railroad Retirement

The top 5 reasons a retirement tax is required

... and why ANY "Property Tax Elimination" plan requires it>#1 - Your kids and grandkids will shoulder the tax burden

$16B is the cost of school property taxes. Our plan is to eliminate ALL of it, forever!

$16B is the cost of school property taxes. Our plan is to eliminate ALL of it, forever!

Seniors/Retirees have been burdened by the awful property tax. In fact, the PA Independent Fiscal Office estimates that while seniors make up 20% of PA's population, they pay 32% of all property taxes on homes! Property taxes are vastly unfair. It leaves them choosing between heat in the winter, or losing their home from unpaid property taxes. (10,000 Pennsylvanians per year lose their homes unnecessarily due to unpaid property taxes.)

If we take the entire $16B and drop it on our kids/grandkids, we will simply be removing the pain we experienced for so long, and move it to our kids & grandkids instead. They will shoulder the burden and suffer just as we have done. Many of our kids/grandkids will leave PA to more favorable states. (See #3 below on the fiscal impacts.)

Our plan taxes the working families (our kids & grandkids) through the Income and Sales tax. In fact, in our own calculations, even while extending the Income tax to include retirement income, the plan would mean 80% of the Income/Sales tax will still land on working families. (Some very wealthy retirees would have you believe the ratio is in the other direction.) For PA's most vulnerable seniors/retirees, it exempts Social Security, the sole income for 1 of 3 retirees! This still lets us give a well-deserved advantage to seniors (who as a group see 50-75% reduction in overall school property tax burden), but fairly distributes the costs among all Pennsylvanians.

#2 - The Retirement tax is coming to PA, with or without property tax elimination

Do you know what we think would be worse than taxing retirement to eliminate property taxes? A future governor taxing retirement ON TOP OF property taxes.

Many of us believe the state government has its eyes on your retirement income. For states with a personal income tax, PA is 1 of 3 remaining states that does not yet tax public/private retirement income. We see it as inevitable, and a retirement tax going to happen at some point.This is why we believe our plan is protective of seniors/retirees. The bottom line: If PA is going to tax retirement anyway, make sure we get something out of it, like school property tax elimination!

#3 - Without it, increased costs of senior care will bankrupt Pennsylvania

If you read #1, you'll recall that without a retirement tax, the burden will fall almost entirely on the working class of PA.

If you read #1, you'll recall that without a retirement tax, the burden will fall almost entirely on the working class of PA.-

- The costs for senior care are $3B

- PA is only 1 of 3 states with an income tax that 100% exempts retirement

- Senior care costs are largely funded largely by the working class

- The working class contributes a the lion's share of tax revenue

Result: PA is very attractive to retirees already. Seniors are moving to PA because it is already tax favorable. Working families are moving away from PA because it is unfavorable.

- PA becomes even more attractive to seniors/retirees who move to PA in droves, and the cost of senior care skyrockets.

- PA becomes even less attractive to the working-class who move out of PA in droves, and take their tax revenue with them.

Result: PA would now have a shrinking tax base to pay for costs that are growing.

The fiscally irresponsible thing to do is be short-sighted: Toss the burden (of healthcare AND property taxes) on working families, and in a few years of PA headed into bankruptcy, add a retirement tax AND re-instate the property tax.

Bottom line:

The fiscally responsible thing to do is to ask everyone to pay a fair share. And, by adding exemptions for Social Security or low-income residents, seniors still gain an advantage over working families, but just enough that still ensuring PA's financial future is secure.

#4 - Senior/Retired homeowners will save the most money, even with a retirement tax

- Today, seniors (as a whole) pay between $2.4 and $2.7B in property taxes. That amount drops to $0 if school property taxes are eliminated.

- Many retirees rely on Social Security only. Because SS is exempt in our plan, they will not see any additional tax (other than a modest +2% sales tax).

- Expanding the income tax to include (non-SS) retirement distributions would raise $1.3B in revenue.

- Meaning: $1.3B is the total retirement tax (on non-SS income) in exchange for $2.4-2.7B eliminated property taxes

Seniors (as a whole) in this plan save the most money (compared to working families). And, a majority of seniors will see significant savings. PA's most vulnerable, those on Social Security alone (or very low income residents) will save the most.

Lastly, for the few well-off seniors that will pay more, they will see savings later. (If property taxes aren't eliminated, their property tax bill will continue to rise at 3.2% per year.) Even seniors with modest pensions still save costs. (It's only the minority of seniors with cadillac pensions that may not see savings in the short term.)

Are you wondering how to calculate your own tax impact? Please use our Estimator designed just for that purpose!

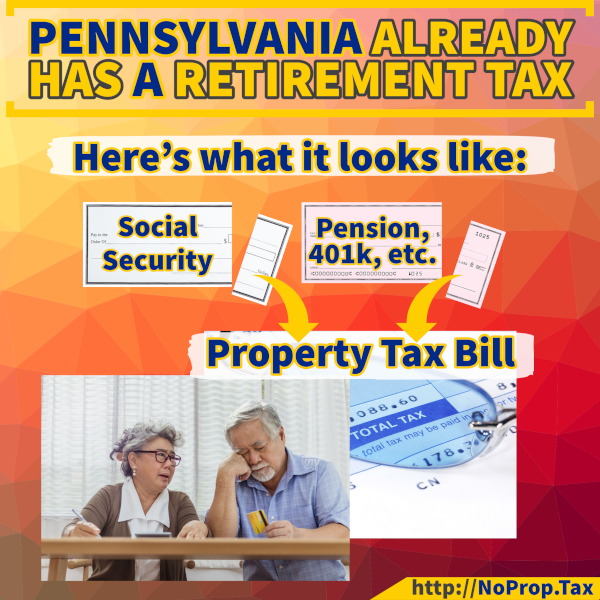

#5 - Pennsylvania already has a tax on retirement

You may have heard Pennsylvania is 1 of 3 states to NOT tax retirement.

In fact, you may think you're pretty lucky that PA doesn't tax Social Security.

You've been tricked!

Today, a senior getting $20,000 in Social Security and paying a (statewide average) $2,500 school property tax gives up 13% of their Social Security check to the School Property tax.

That's effectively a 13% tax on their Social Security check! (Those on Social Security only know this well.) If you're among the lucky few seniors who still have a pension.

Worse, if you've been in Pennsylvania long enough, you know that every year, the School Property Tax grows faster than your Social Security check. And, if you have a fixed pension amount, the amount you retain gets smaller each year as the school property tax eats larger and larger bites.

In our School Property Tax Elimination plan we exempt Social Security entirely, ensuring seniors who depend on it are saving the most!

Please use our Estimator to see what it means for you.